|

|||||||||

|

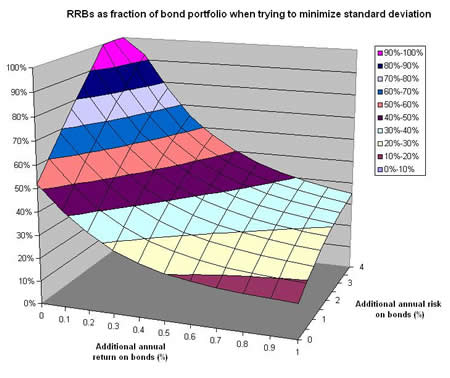

Nominal bonds, indexed bonds, or some of each? To minimize taxes, bonds should usually be held in tax-deferred accounts like RRSPs. In such accounts, it is possible to use nominal bonds, which pay a fixed interest coupon twice a year. Since the early 1990's, the Government of Canada has also issued indexed bonds (called "real return bonds" or RRBs; the U.S. issues similar bonds called TIPS) which also pay a coupon twice a year but on a principal amount that is automatically increased by inflation. If you have never heard of indexed bonds, there is an excellent webpage here. From here on, we will call regular bonds "bonds" and indexed bonds "RRBs". Because we want a common frame of reference, we will use real returns; i.e. returns after inflation. For RRBs, that is the commonly stated return; for bonds, that is the nominal return less the inflationary increase over the holding period. Because the coupon on a bond is fixed until maturity, holders can see their real incomes decline severely when inflation is high. RRBs protect the holder against this risk. Should you prefer one over the other, or use a combination? First a warning: Because the principal increase on RRBs is taxed in the year it happens, while it is not paid to you until maturity, holding RRBs in taxable accounts is very unwise. In a registered account, though, a combination may be worth your while. Bonds and RRBs do not move perfectly in tandem as interest rates change. Whenever you have two asset classes with an imperfect correlation, a diversification opportunity exists. Recent history is that returns on Canadian bonds and RRBs have a correlation of about 0.65, so some investigation is in order. Returns on bonds and RRBs have not been very volatile recently but that is not always the case. For the purposes of this study, we take base case standard deviations to be about 10% per year. Since our interest is not reliving the past but constructing a portfolio for the future, all returns in the following discussion are expected returns. Bonds have more risk than RRBs, in particular inflation risk. As such, we should expect returns to be higher on bonds to compensate for that additional risk. Suppose we vary the incremental risk and real return for bonds over RRBs, their indexed cousins. Then we can calculate what proportion of the bond part of an efficient (well diversified) portfolio should be in RRBs for varying combinations of added risk and return. For an investor who is quite risk averse, the result of the calculations can be seen in the graph below. Picking out a few obvious data points, if bonds and RRBs have similar returns and volatility, then we should invest about half the portfolio in each. If we expect the returns to be similar, but standard deviations on bonds to be 3% or more higher than on RRBs, then the portfolio should be 100% RRBs. If bond returns exceed RRB returns by 1%, then the RRB part of the portfolio varies from about 15% with similar volatilities up to about 35% if bonds have a 4% higher volatility.

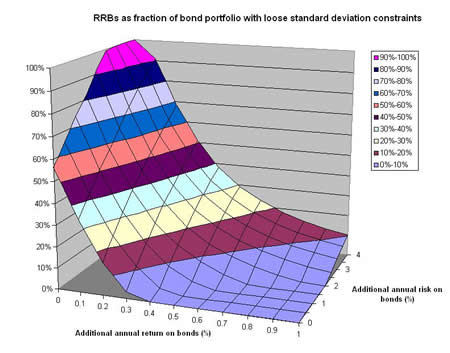

An investor who is less concerned about the volatility of the portfolio's market value and more interested in higher overall returns would use the graph below instead. Once again, if expected returns are similar, the RRB portion of the portfolio rises from about 50% when bond volatilities are similar to 100% when volatilies are much higher. However, if expected returns on bonds are higher than on RRBs, the RRB portion of the portfolio falls much more rapidly than for the very risk averse investor. |

|

|||||||